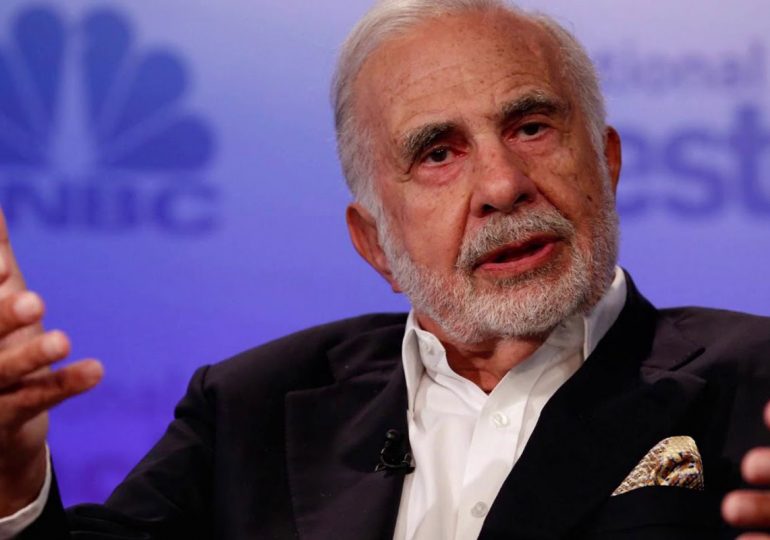

Carl Icahn is a raider and philanthropist

People in the United States know: if “corporate raider” Carl Icahn decided to sell the shares of any company, then all its value is squeezed out of the company.

By half a century of work Icahn earned a capital of 24 billion dollars and earned respect and fear in the professional environment. In 2016, the elected President of the United States, Donald Trump, offered the position of an independent consultant on regulatory policy reform issues to the financier. At the same time Icahn retained his business.

Engaged in unethical actions against weak companies, Carl Icahn at the same time donated to charity. In particular, in 2016, he gave $ 1 million for the needs of veterans of the US army.

But the entrepreneur reached such heights not immediately. Carl was born on 16 February 1936 in a poor Jewish family on the outskirts of Brooklyn (New York). The boy’s father believed that the main thing is ”to keep a low profile”, so sent his son to a regular public school. At the same time, the elite educational institution Woodmore accepted Carl Icahn and was ready to pay for the study of young talent.

Behind the financier – Princeton University and the title of bachelor of philosophy. In the 80s, the businessman made a fortune on so-called junk bonds and became the king of corporate raiding and greenmail (blackmail). This type of activity is aimed at undervalued companies and involves the sale of shares to the Issuer at inflated price. But greenmailer not really interested in the takeover of a company, the price of the asset which exceeds its market capitalization. Carl Icahn was mostly interested in making a profit.

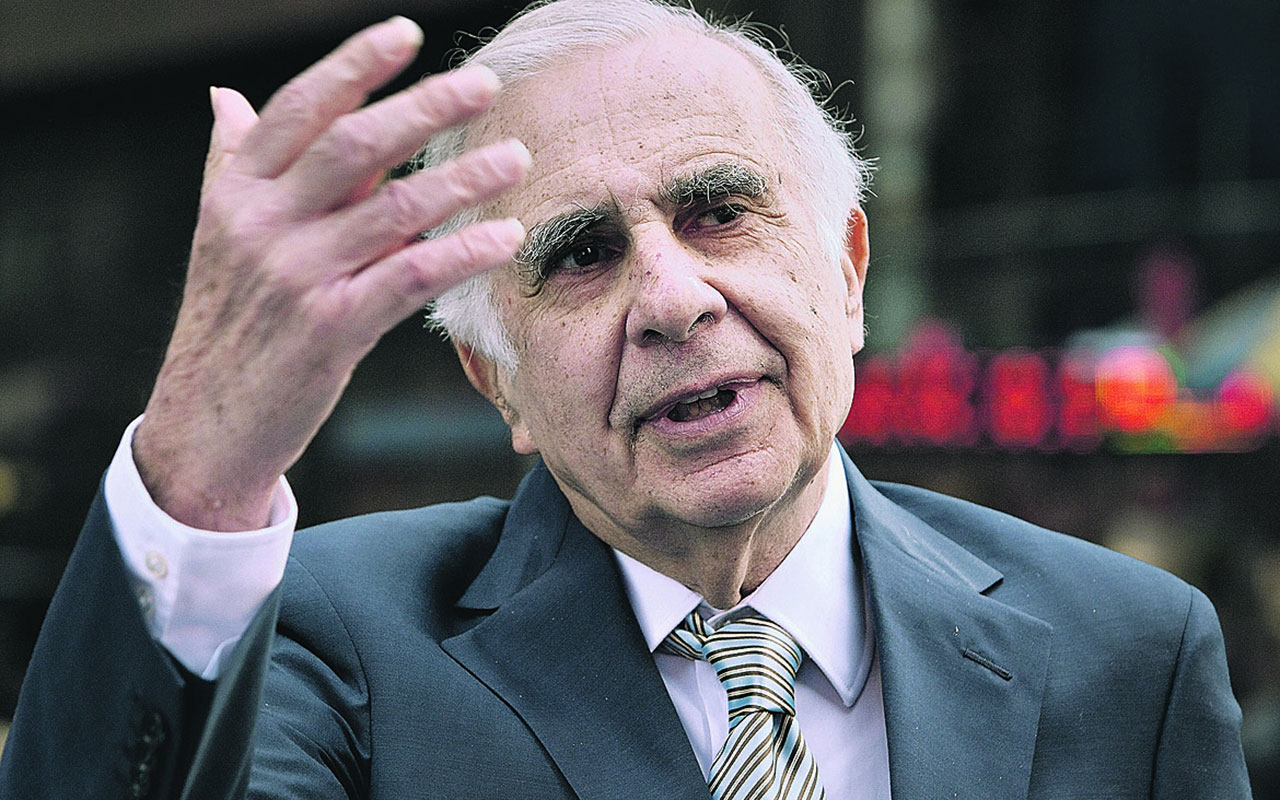

Carl Icahn and a tough approach to companies

As it is known, there are two main ways to make a profit from the shares. The first one is buying and selling fast. The second is acquisition and storage. In any case, the shareholder receives a share of the company and becomes its co-owner. Who, in turn, takes part in meetings of shareholders and influences key decisions. But most shareholders are only interested in income from securities. Making decisions for them is not the main thing.

In his experience, the businessman proved that it is possible to achieve significant profits by acquiring a share in companies with highly undervalued shares. Further, having received a share in the company, the raider acts depending on the adopted action plan. For example, greenmailer bluffs by offering to sell the company to a third party. Or even close. Also popular tactics are proxy wars, when the management of the organization is divided into two camps and “fights” with each other. Then there is a “peacemaker” and offers to solve everything through the sale. The management of the weakened company is offered to buy it out or sell the share back – at an inflated price.

So did Icahn with the manufacturer of kitchen stuff Tappan. It turned out that the value of the organization was half that of its assets. Carl began to actively buy shares, started a war with someone else’s hands and assisted in the sale of the company to the Swedish holding Electrolux at a real price, i.e. twice as much as at the start. Thus corporate raider became 2 times richer.

The thirst for personal gain forced Icahn to ruin TWA – in due time the largest air carrier of the United States.

If Icahn actively buys securities of any company, often he immediately receives an offer to buy back the share (of course, to the benefit of the failed shareholder). No one wants any trouble.

In general, despite the controversial methods of work, Carl Icahn and his colleagues keep the market in good shape: nothing personal, it is just business.