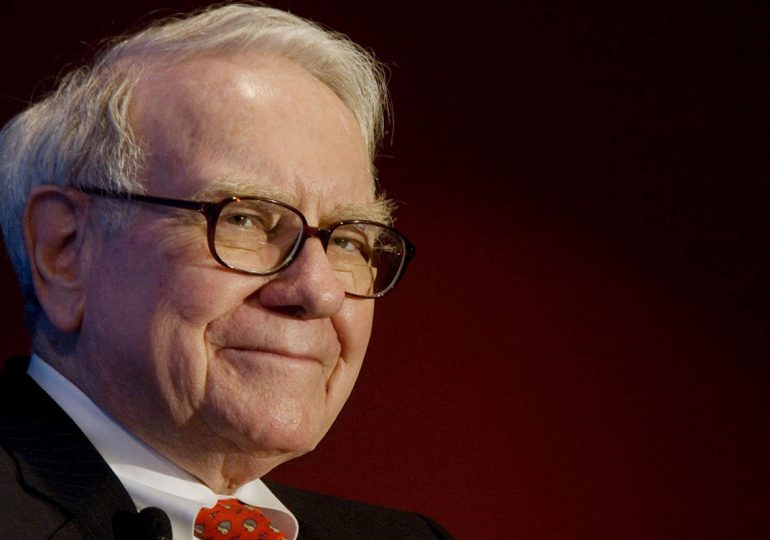

The story of Warren Buffett: a long way to success

The greatest investor, one of the richest man in the world Warren Buffett is 88 years old. His wealth can be estimated only approximately. Official sources say about $ 108.4 billion in September 2018. A few months earlier, another figure was published – 82.5 billion, which once again emphasizes the volatility of the stock market. At the same time we are talking exclusively about the share of Buffett in the American holding company Berkshire Hathaway.

Speaking about the success of Warren Buffett in matters of investment, one should only pay attention to the fact that the shares of Berkshire Hathaway grew in price by an average of 21% per year from 1965 to 2016.

Berkshire Hathaway consists of 60 different organizations. It includes an insurance agency, a large restaurant chain, popular mass media and even a well-known battery manufacturer.

The billionaire, who is going to spend 99% of the earned money on charity, was born on 30 August 1930. The father of the future genius of the stock markets once traded shares, but as a result became a senator. Buffett family moved to Washington. Warren’s first pocket money did not come from a wealthy father. The boy sold Washington Post in the morning. And many years later acquired a share in the publication (which increased 100 times).

Buffett bought his first share at 11 and filed a tax return at the age of 13.

The story of Warren Buffett: when the student has found the teacher

But it was not the early experience of the stock market that changed Warren Buffett’s life. A crucial role was played by acquaintance with Benjamin Graham, the author of a number of books and such areas of investment as fundamental analysis of assets.

One of the main ideas of the master is the purchase of undervalued shares. To do this, deep evaluation of the market and its prospects are needed to find firms that are worth much more than the market believes.

When analyzing the reporting of companies, Graham paid special attention to such an indicator as the value of net assets attributable to 1 security.

Graham and Buffett worked together only two years. But it was enough for Warren to be king of Wall Street. Having created the world’s first hedge fund and earned a lot of money, Benjamin Graham retired.

Warren Buffett returned home to Omaha. 25 years old young man already had 127 thousand dollars, which in 2018 would be equal to more than a million.

Buffett became popular thanks to the unheard-of and rather risky business model that he offered to customers. If the securities in which the investor has invested grow by more than 4 percent per year, Buffett took half of the growth in the value of assets. A quarter of the losses were recovered.

Thus, the manager and the client had common interests and equally sought success.

Berkshire Hathaway is not the brainchild of Buffett, as it’s generally accepted. Seeing the shares of the company, the financier decided to buy them for $ 8 apiece. It remains a mystery how Warren noticed the prospects of Berkshire: prior to the purchase, the company suffered losses for 7 consecutive years.

In general, in assessing the real assets of the companies Buffett outdoes to this day: despite his venerable age, the great financier still heads the Board of Directors of Berkshire Hathaway holding.